01

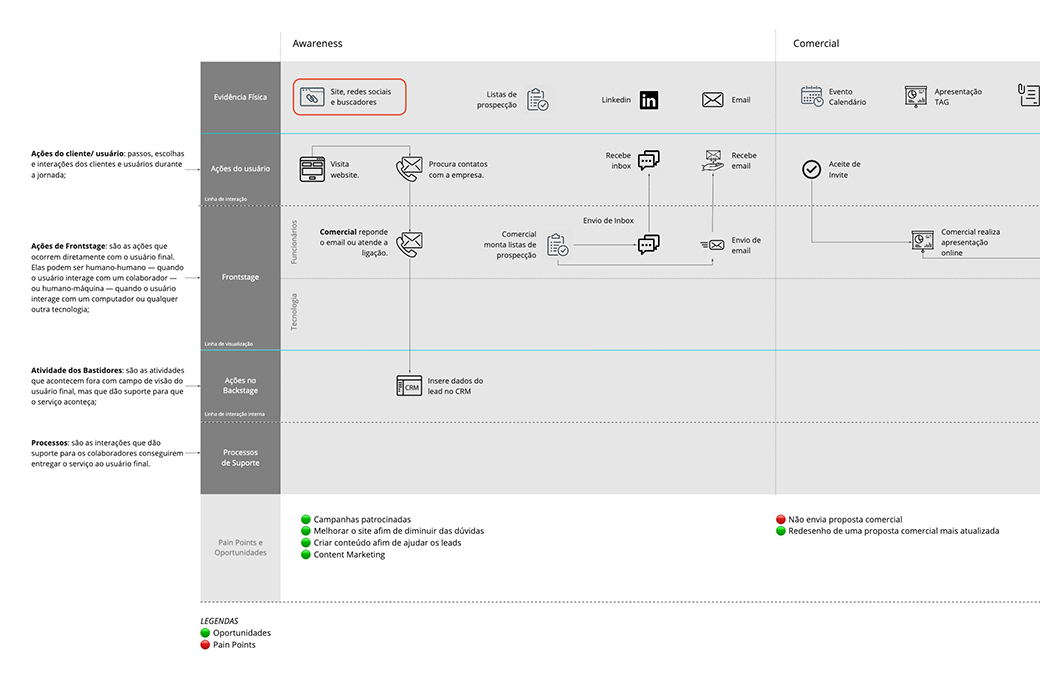

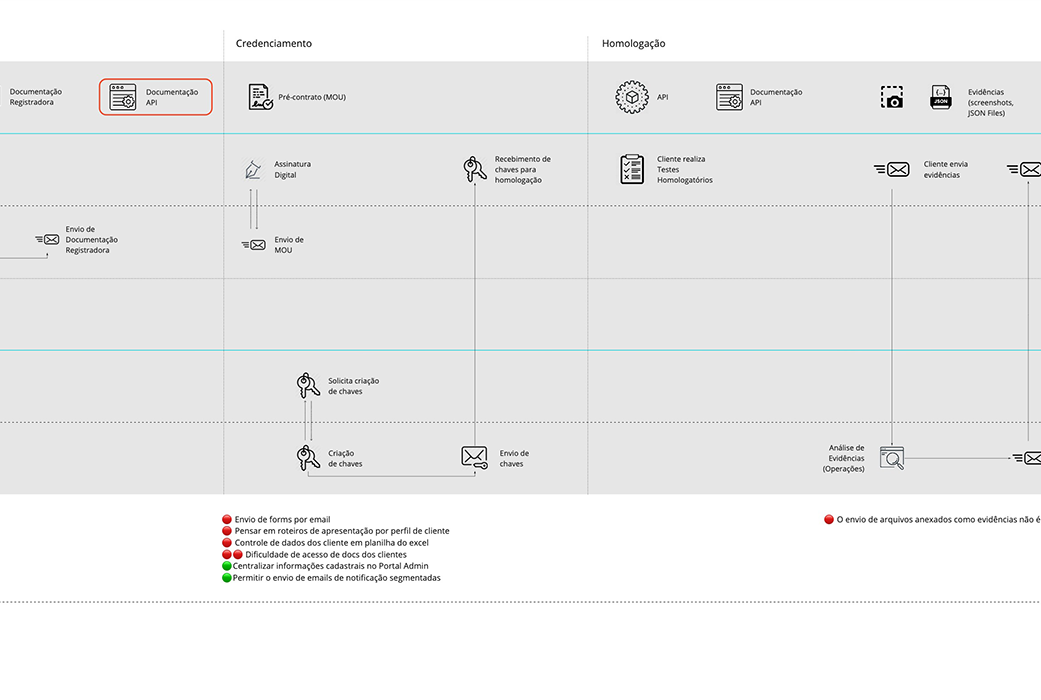

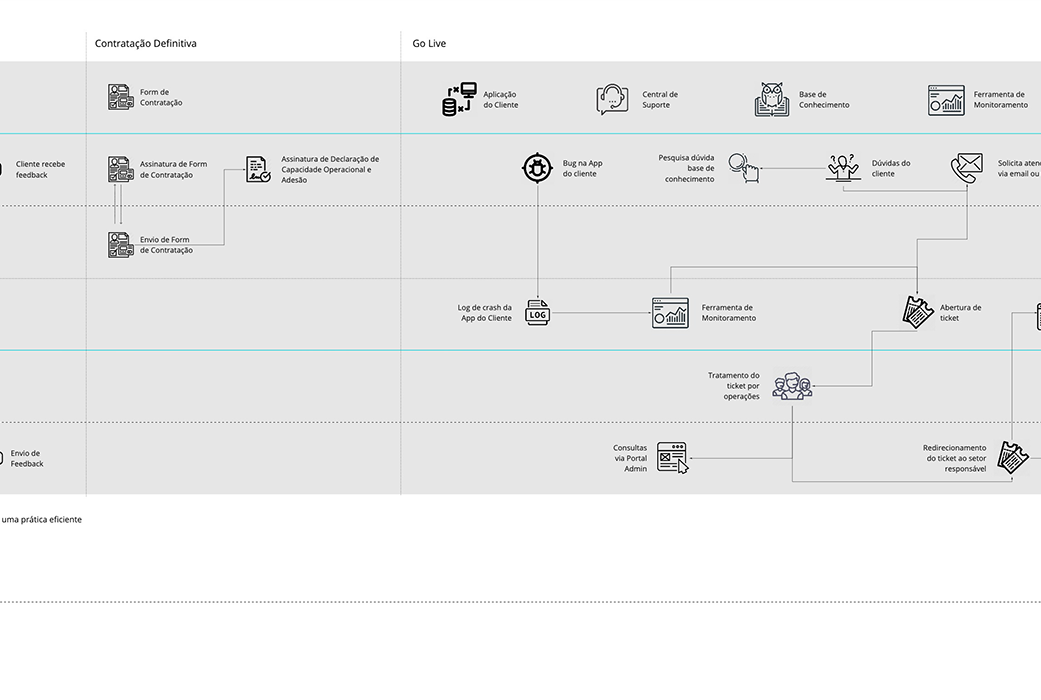

Problem.

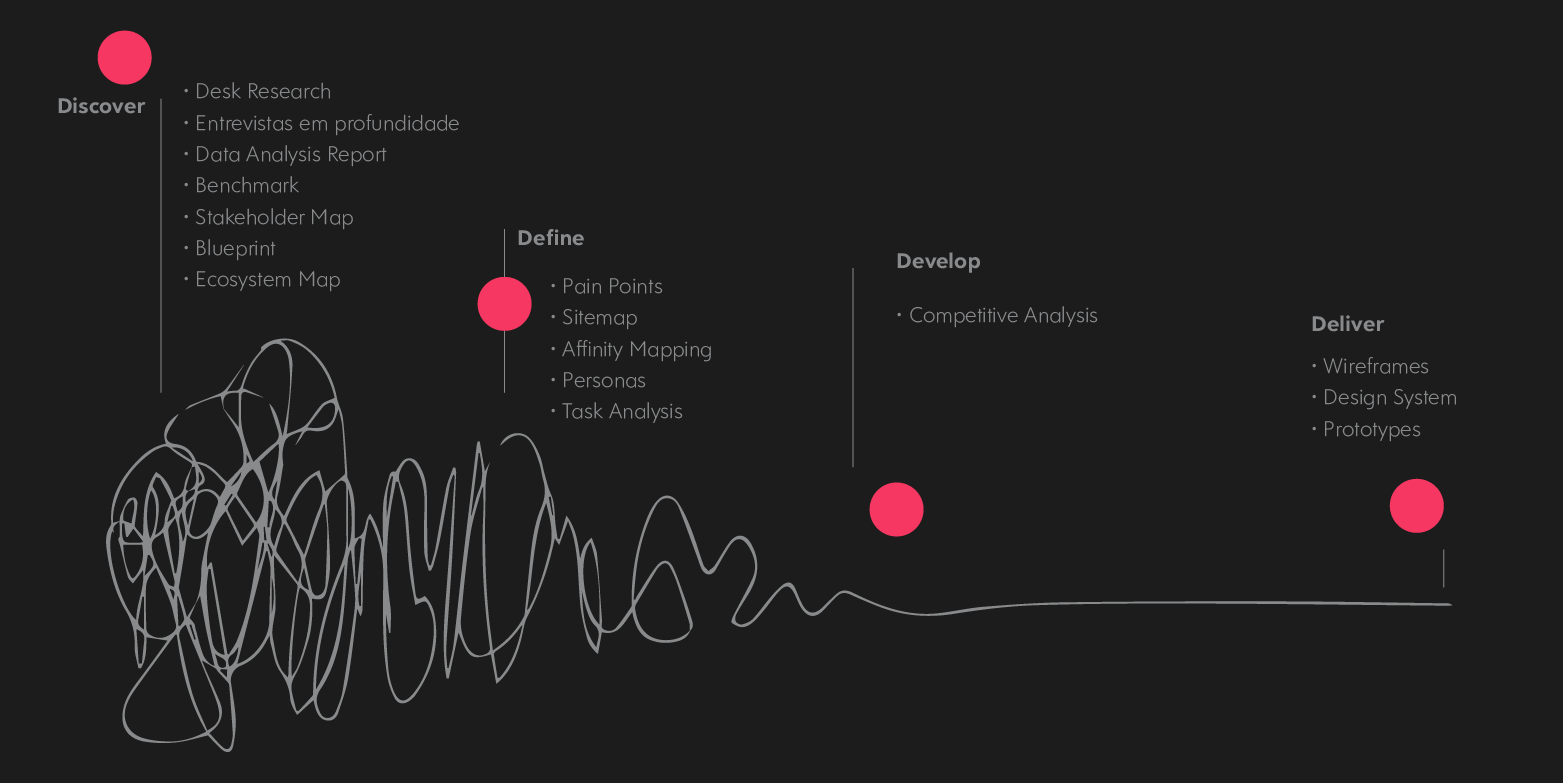

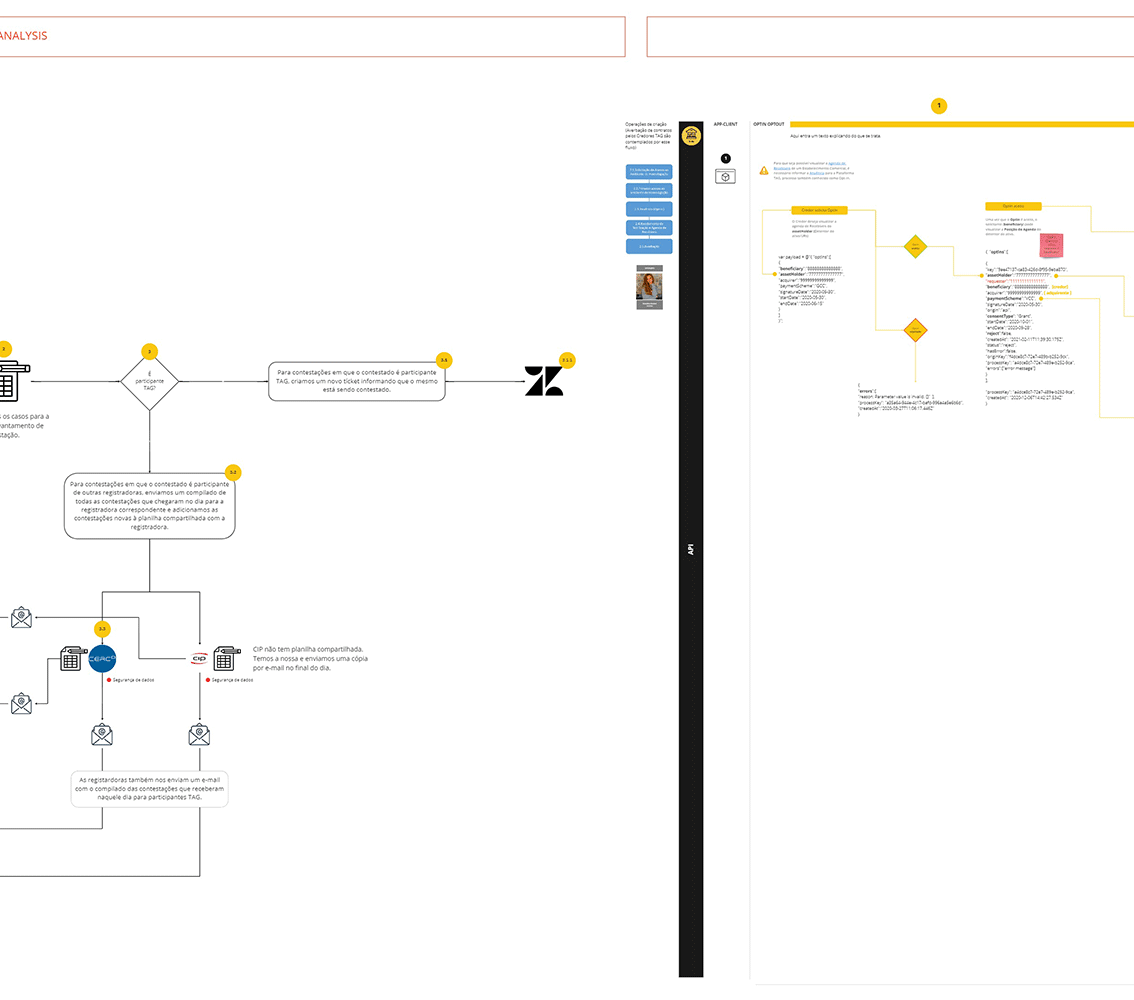

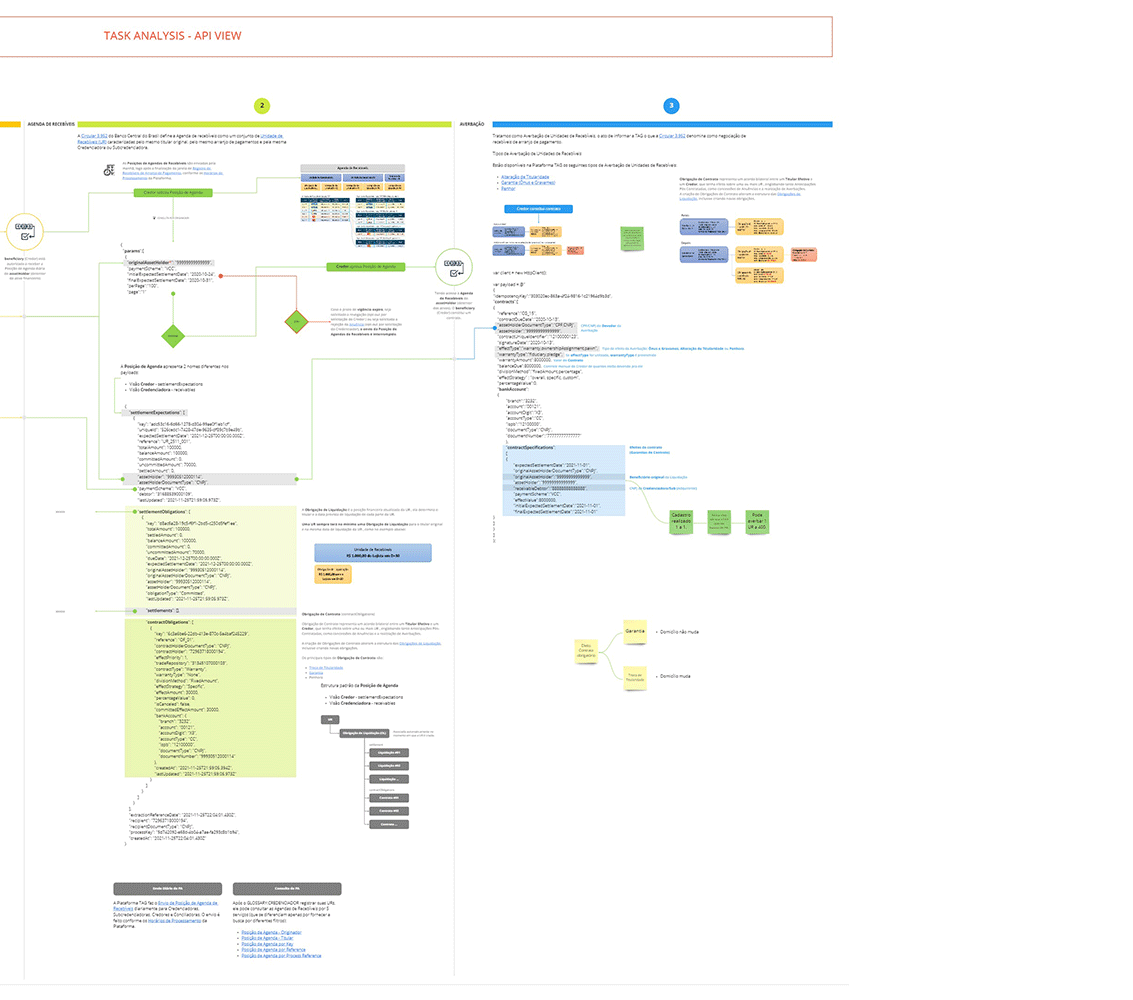

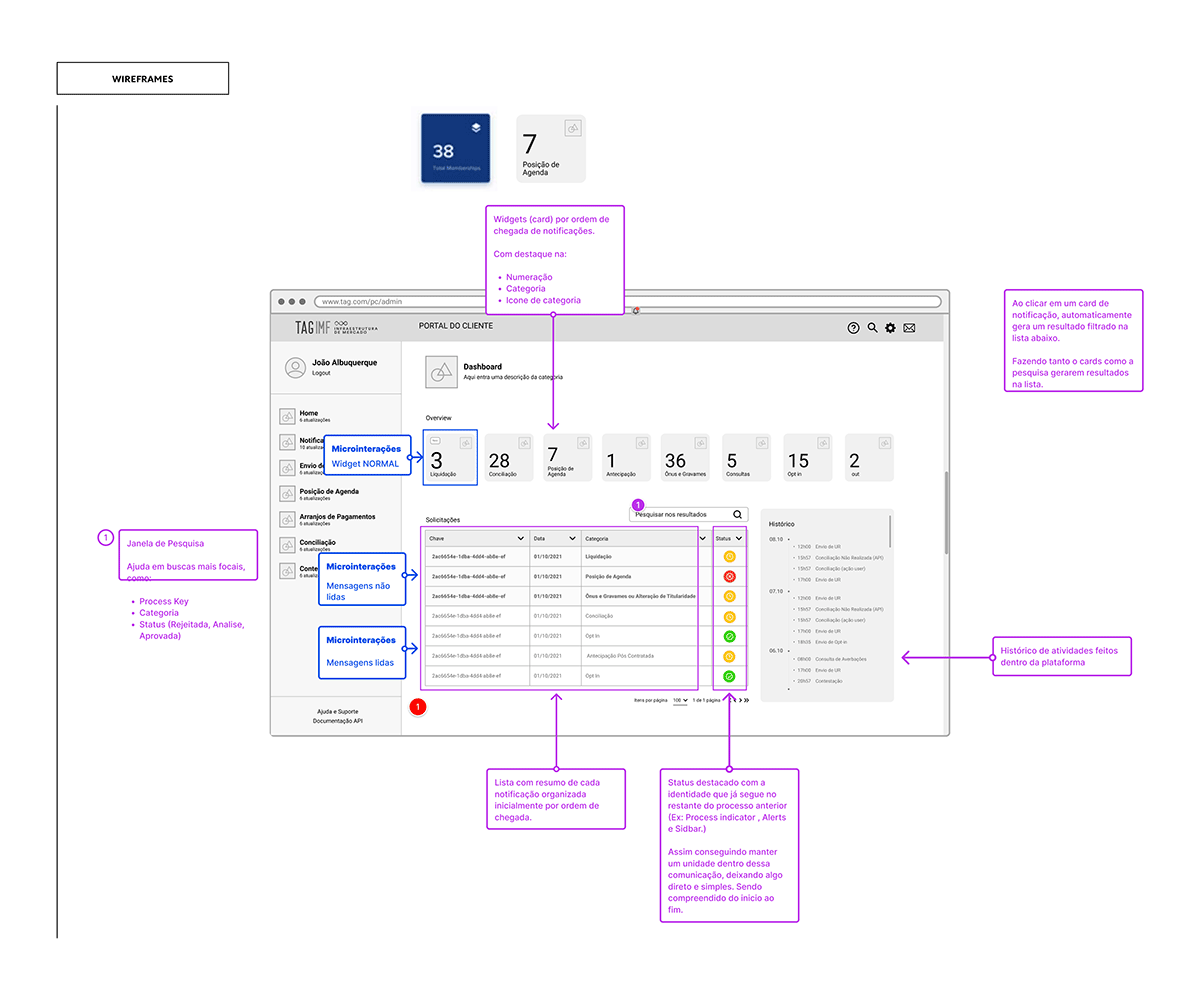

Approaching the problem from the most diverse perspectives in order to explore its context and understand what are the main needs and pains of users.

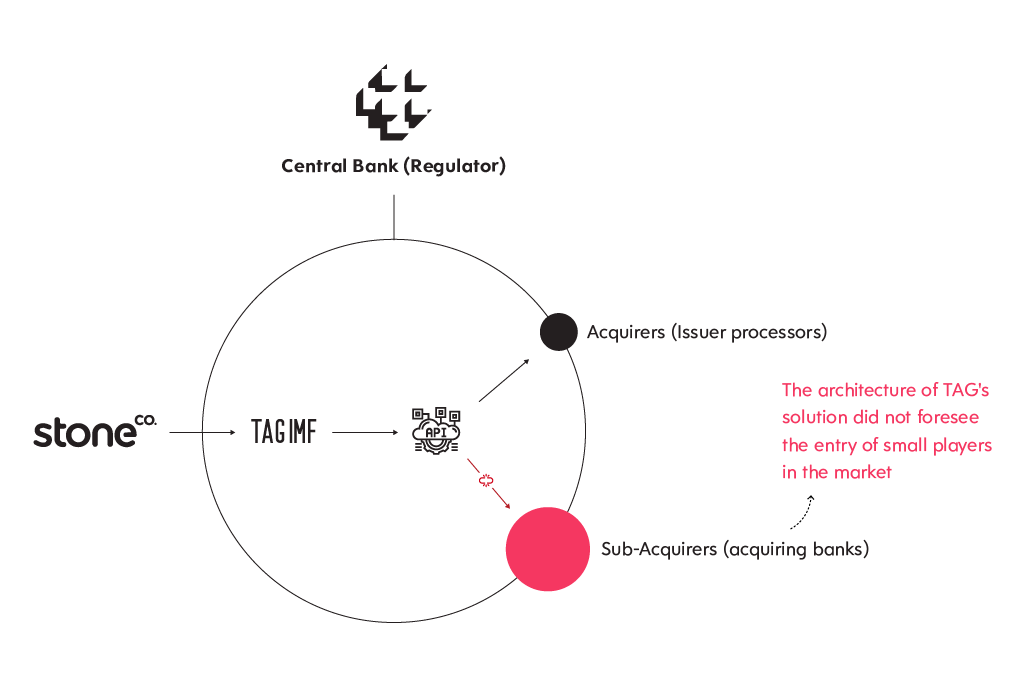

And TAG is a relatively new company with only 2 years of experience in the market. At the time of its conception it was 100% software-based. Initially, it was conceived to meet the needs of the Stone Co. Group's Receivables Records, but with the existing market gaps, it has been consolidating itself as an efficient solution for other players in the financial market.